Reduce Underwriting Time From Days to Minutes

Decrease time-to-decision with this automated underwriting solution that fits in seamlessly with your current system.

10x Faster Underwriting

Decrease Time-to-Decision

Our solution will assist you in every step of the digital underwriting process. See how you can put an end to inefficient underwriting processes and merchant abandonment.

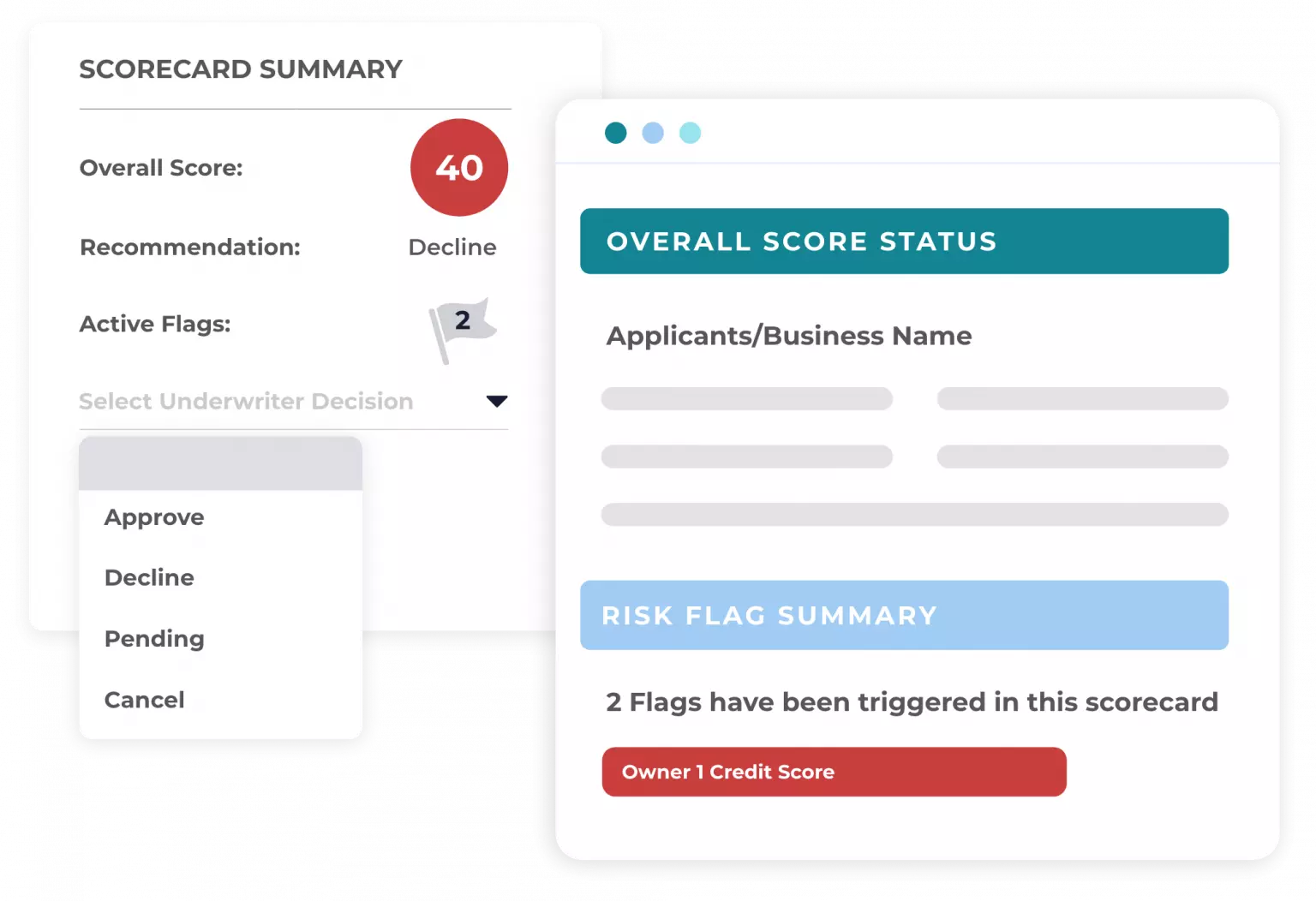

Talk To Our TeamCustomizable Risk Scoring

Cater your scoring models to merchant risk types and

board through multiple processors with our advanced

library of integrations and scoring rules.

Automatic Data Collection

Save money with built-in business intelligence tools. Automate KYC and AML data collection for a central source of truth.

Underwriting With ScanX

Automate your merchant experience, determine risk and onboard in minutes. That’s the power of innovation.

NMI’s Underwriting Tools Were Built For:

Mature wholesale ISOs

ISOs currently taking on risk or becoming a PayFac

Sponsor banks

Payment facilitators

Merchant acquirers

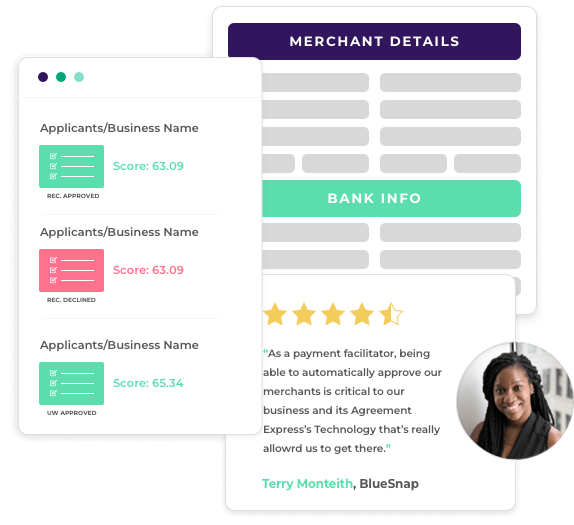

“Supporting our payments partners in their goals to bring payment solutions to their clients quickly and efficiently is a critical aspect of our program.”

Nicolas Karmelek

Executive Vice President & Chief Risk Officer at Avidia Bank

Process 10x more applications per underwriter

Access 100+ pre-configured scoring rules

See a 70% reduction in merchant abandonment

Save up to $60 in third-party fees per application